A Tracking Tax on trucks would raise prices on consumers and jeopardize countless trucking jobs.

More than 50 leaders from the Texas trucking industry recently flew to Washington, D.C. to meet with the state's Congressional delegation on Capitol Hill. In 38 separate meetings with lawmakers and their staffs, we discussed how Congress can best partner with truckers to keep America's economy moving forward.

One issue in particular was top of mind: a “truck-only” vehicle-miles traveled (VMT) tax scheme floating in the U.S. Senate. The proposal calls for government-mandated electronic logging devices inside privately-owned vehicles to track truckers’ movements and report them back to the Internal Revenue Service (IRS) -- enabling the IRS to tax trucks on every mile they move.

Using electronic logging devices to track working Americans so the IRS can take away more of their earnings is not something we expected a senator from Texas would support. Which is why we were surprised by news reports that Senator John Cornyn is a leading proponent of the truck-only VMT tax.

“We're going to make it happen,” Cornyn said.

In fact, a similar VMT scheme was just recently defeated in the Texas state legislature, because Texans know a raw deal when they see one.

While we're encouraged by recent reports from Senate Finance Chairman Chuck Grassley from Iowa that the proposal currently lacks support in the committee, we continue to press the Texas delegation to oppose it, and we hope that Senator Cornyn will reverse course.

Here are three reasons why a Tracking Tax would be bad news:

1. It would throw a wrench in our economic engine and increase prices for consumers.

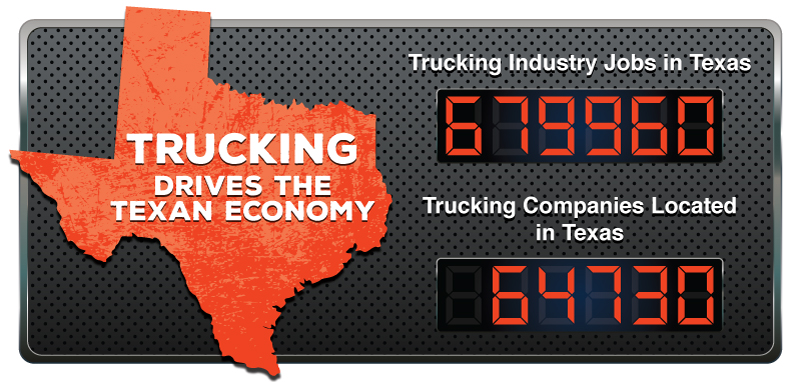

The Texas business community knows that trucking is the backbone of the economy, because virtually every single item Texans use and rely on in daily life are available and affordable thanks to trucks. More than 80% of Texas communities rely solely on trucks to move their goods.

When policymakers hammer the trucking industry with punitive tax schemes, the pain is felt by all sectors we serve: energy producers, cattle, hog and sheep exporters, manufacturers, retailers, grocery stores, health care providers, mom and pop shops, and so on. As their operating costs increase, so do the prices consumers see in the store and online. When the cost of truck transportation goes up, the price of everything goes up.

That’s why the Texas Ag Industries Association, Texas Citrus Mutual, and the Texas Grain and Feed Association have written the Senate Finance Committee urging them to reject this proposal:

“For our respective agricultural organizations, a truck-only vehicle miles tax would increase truck transportation costs, leading to lower farmgate prices and reduced market share for U.S. agriculture versus our foreign competitors.”

2. It would jeopardize countless trucking jobs across Texas and the United States.

All Americans should know: When it comes to funding the roads and bridges that Americans use every day, the trucking industry more than carries its weight—and we’re proud of the fact.

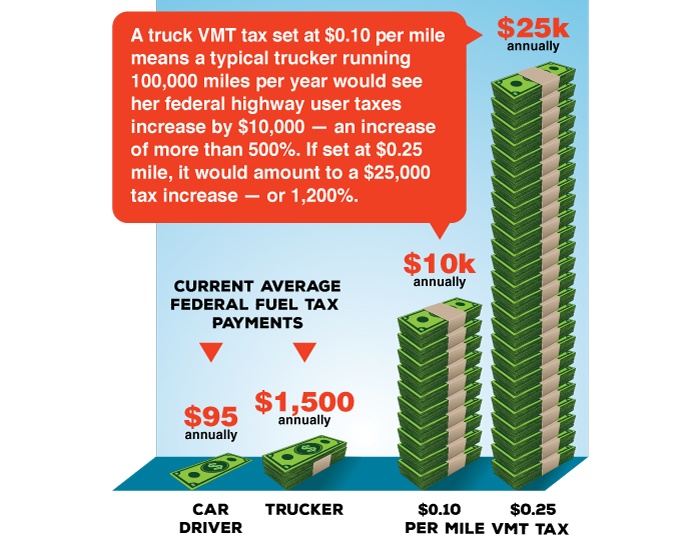

Every truck you see on the road is paying far more in highway use taxes than any car. While a typical car driver pays $95 each year in federal gas taxes, the average truck pays $1,500 (plus an additional $550 heavy-use tax, a tire tax, and other assorted excise taxes that trucks are subjected to).

Out of the 270 million vehicles on the road, trucks are fewer than 4% – yet our industry pays nearly half the entire federal Highway Trust Fund tab. But the Tracking Tax favored by Senator Cornyn would shift the burden to a further extreme, placing it almost entirely on the backs of truckers.

For a typical Texas trucker running 100,000 miles in a year, a Tracking Tax set at $0.10 per mile would increase their federal highway user taxes by an additional $10,000 -- a 500% increase above current levels. If set at $0.25 per mile, it would amount to a new $25,000 tax every year -- or a 1,200% increase. For a midsize fleet of 30 trucks, that represents a new $750,000 tax bill that didn’t exist the year before.

Trucking is an industry dominated by small, family-owned businesses. More than 91% of motor carriers operate fewer than six trucks. For most carriers, the inordinate financial burden inflicted by a Tracking Tax would be simply unsustainable. It would force many motor carriers to close, costing countless good trucking jobs across the state and beyond.

Trucking isn’t an easy job, but truckers take it on with a powerful purpose: to provide for their families and to deliver the quality of life that all Americans enjoy. What they ask for in return are government leaders who can appreciate the challenges of life on the road while maintaining a profitable business that survives on razor-thin margins. The last thing they need is lawmakers shaking them down and treating their trucks like Congressional piggy banks.

3. It won’t do anything to solve America’s infrastructure crisis.

Nobody sees the need for safe and secure roads and bridges more than truckers do, which is why our industry has led the charge for greater federal investment in infrastructure. But growing government payrolls in D.C. at the expense of trucking jobs across the country is not the answer.

Responsibly funding national infrastructure begins with a fair, viable and fiscally-conservative source of user-fee revenue that is ready to address our immediate needs today. That will provide the needed cushion over the next decade as we work strategically toward a longer-term funding mechanism to replace the fuel tax as gasoline grows obsolete.

President Ronald Reagan twice enacted modest gas tax increases, because he knew it protected taxpayer dollars from waste and abuse and also delivered the greatest return of value to the motoring public. Ninety-nine cents on every dollar of gas-tax revenue flows directly into infrastructure investment, rather than being syphoned away to pay the salaries of IRS agents and other bureaucrats needed to run a VMT tax scheme.

The reason roads and bridges are in such bad shape today is because Congress has failed to adjust the fuel tax for inflation since 1993. But that hasn’t saved motorists anything. Because Congress failed to do its job, the typical motorist now loses $1,600 every year in wasted gas, lost time and vehicle damage caused by poor roads and the traffic congestion they produce.