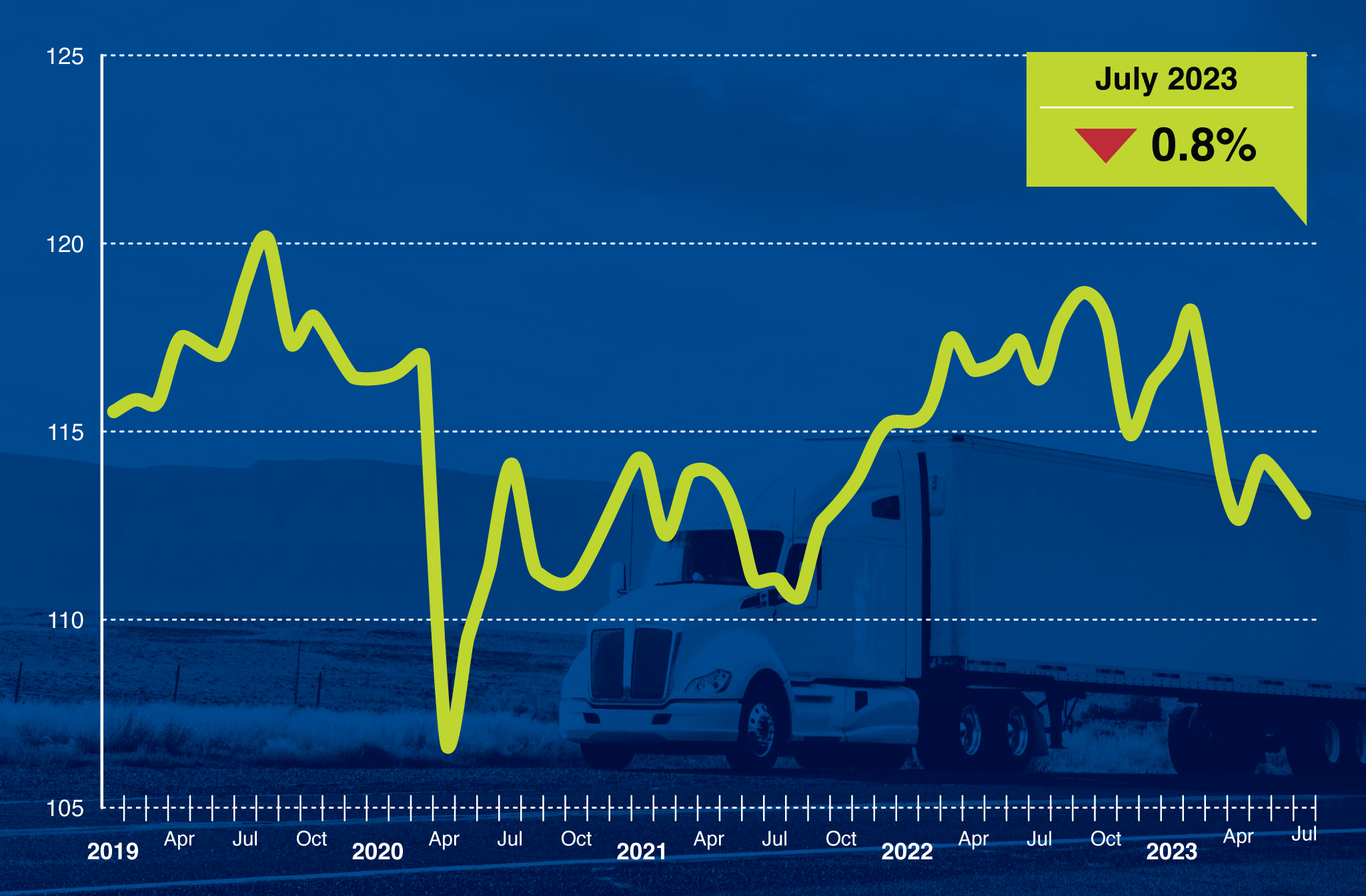

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.8% in July after falling 0.3% in June. In July, the index equaled 112.9 (2015=100) compared with 113.8 in June.

“Headwinds for freight remained in July, pushing the truck tonnage index lower,” said ATA Chief Economist Bob Costello. “As has been the case for several months, a multitude of factors have caused a recession in freight, including sluggish spending on goods by households as consumers traveled more and went to concerts this summer. Less home construction, falling factory output and shippers consolidating freight into fewer shipments compared with the frenzy during the goods buying spree at the height of the pandemic are also significant drags on tonnage.”

June’s increase was revised lower from our July 18 press release.

Compared with July 2022, the SA index fell 3%, which was the fifth straight year-over-year decrease. In June, the index was down 3.2% from a year earlier.

The not seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 111.5 in July, 5.5% below the June level (118). In calculating the index, 100 represents 2015. ATA’s For-Hire Truck Tonnage Index is dominated by contract freight as opposed to spot market freight.

Trucking serves as a barometer of the U.S. economy, representing 72.6% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 11.46 billion tons of freight in 2022. Motor carriers collected $940.8 billion, or 80.7% of total revenue earned by all transport modes.

ATA calculates the tonnage index based on surveys from its membership and has been doing so since the 1970s. This is a preliminary figure and subject to change in the final report issued around the 5th day of each month. The report includes month-to-month and year-over-year results, relevant economic comparisons, and key financial indicators.